CoinDepo - #1 in the Industry

Next Generation Financial Service

for Digital Assets

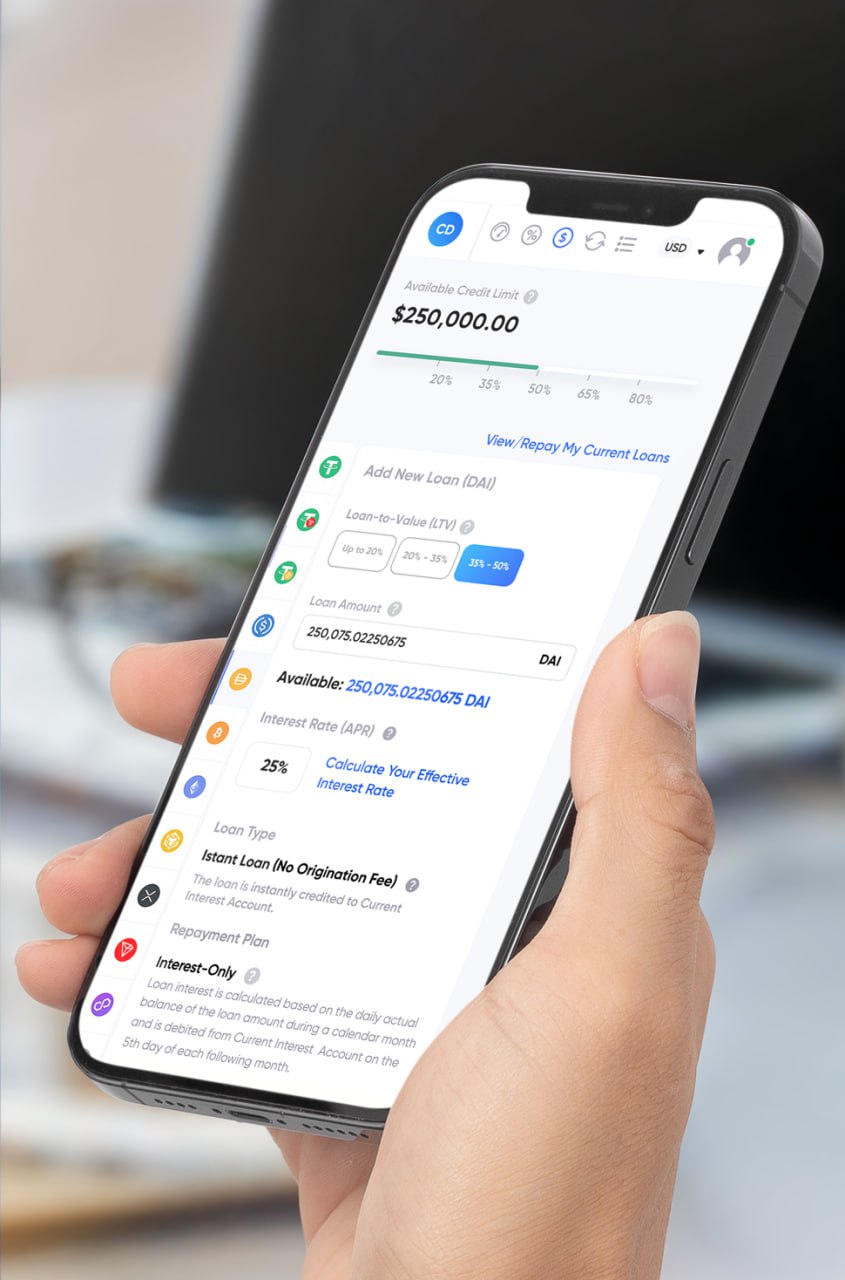

CoinDepo is the first to offer unique types of secured loans and microcredit, allowing users to borrow cryptocurrency and stablecoins without a collateral account. Additionally, we provide a crypto deposit service (Compound Interest Accounts) with high-yield interest rates.

To date, CoinDepo has a long history of successful partnerships with leading microfinance providers in emerging and fast-growing markets. By utilizing high-yield loan products, CoinDepo generates stable high returns on its assets, thereby successfully implementing crypto earning programs with attractive, competitive interest rates for its users.

CoinDepo employs a unique Borrower Approval Procedure, fully compliant with KYC and AML requirements. During this process, Borrowers undergo a comprehensive check and are approved by the Board of Independent Auditors and Auditors Guarantors. Guarantors provide liquidity to the Platform as additional security for loans issued by Liquidity Providers (Loan Overcollateralized Mechanism).

For CoinDepo Users who are Liquidity Providers, the Loan Overcollateralization Mechanism eliminates all risks of loss of deposited assets. In the event of a default by the Borrower, they reimburse their investments and earned interest from the Guarantors' funds held in the CoinDepo Liquidity Reserve Accounts.

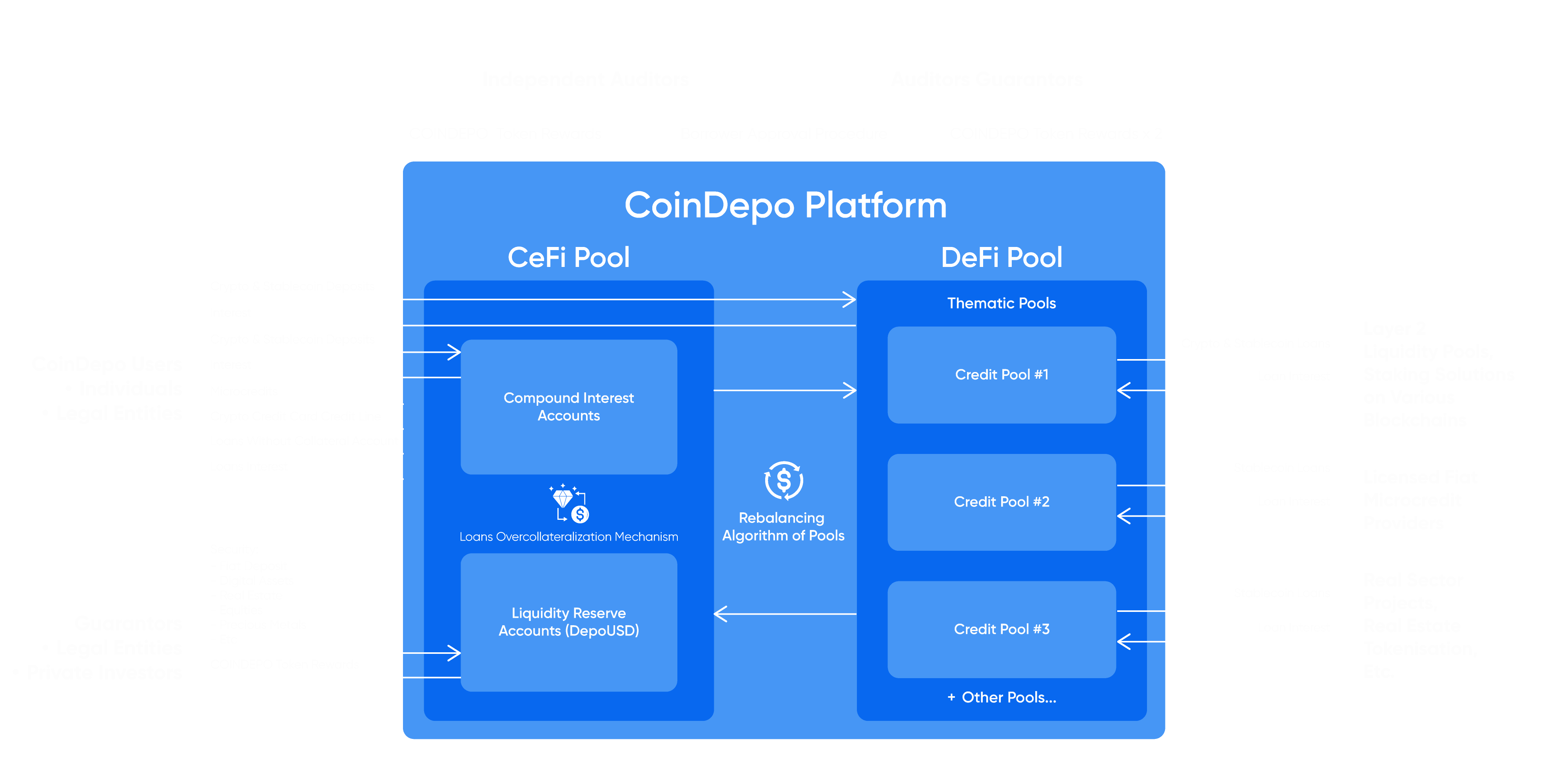

CoinDepo is currently implementing a combined CeFi and DeFi Credit Protocol that will provide unparalleled market advantages to all platform users, both Borrowers and Liquidity Providers.

Unlike other crypto lending platforms, CoinDepo enables Borrowers to obtain crypto loans without collateral in CeFi and DeFi Lending Pools. Liquidity Providers can track all CoinDepo lending transactions on the blockchain and earn high-yield interest with zero risk of losing their deposits, thanks to the Loan Overcollateralized Mechanism and Rebalancing Algorithm of Pools.

CoinDepo Credit Protocol

The Combined Power of CeFi & DeFi Lending Pools

CoinDepo Worldwide Presence

$224,421,470

Crypto Assets

under Management

24%

AUM QoQ Growth (Q3 2025)

106,041

Active

Users

15.6%

Average Yield Paid (Q3 2025)

Compliance with Regulatory Requirements

A strong compliance framework that includes customer identity verification procedures to comply with KYC/AML regulations is critical to CoinDepo's mission to be the most trusted crypto platform. The CoinDepo compliance algorithm is based on the best practices of traditional financial services, as well as unique innovative technologies for ensuring compliance in the crypto industry. We hold ourselves to high standards in what digital asset financial services we provide and who has access to our products.

Please review the documents linked below to learn more about our commitment to compliance and the procedures we use to ensure the safety of our customers' assets.

Why is CoinDepo #1?

CoinDepo is the first in the world to develop unique Earn & Borrow Products for digital assets

High-Yield Earning

-

6 types of Compound Interest Accounts

-

Institutional & VIP Client Solutions

-

Maximum security of your assets

Borrowing without Collateral Account

-

Instant Credit Line

-

Microcredit without collateral

-

Credit Card with crypto cashback up to 8%

CoinDepo Brand

For us, CoinDepo is not just a name. We are sincerely proud of our brand and do our best to make CoinDepo known to as many people who share our aspirations, our vision, and our values as possible.

Feel free to contact us at [email protected] if you would like to learn more about the CoinDepo brand, provide feedback, or discuss opportunities to partner with, promote, or use our brand.

Get more information by downloading the CoinDepo Brand Guidelines, which includes logos, symbols, and a usage guide to help you learn where and how to properly place our brand.

Our Milestones & Roadmap

2021

-

Q1:

Started Product Development

-

Q2:

Established Legal Entity

Integrated with Fireblocks

Implemented Multi-layer Security Technology

-

Q3:

Achieved CCSS Level 3 Compliance

Implemented SSL Data Protection

-

Q4:

Added Support for USDT, USDC, DAI, BTC, ETH, XRP, LTC, BCH

Implemented Full Insurance of Deposited Assets

Launch of the CoinDepo Platform

2022

-

Q1:

Implemented Automated KYC Process

Developed Loan Overcollateralized Mechanism

-

Q2:

Launched the CoinDepo Referral Program

-

Q3:

Released Services for Institutional and Corporate Clients

-

Q4:

Created Private VIP Client Support Service

Reached $10M in Crypto Assets under Management

2023

-

Q1:

Added BNB Support

Launched the CoinDepo Affiliate Program

-

Q2:

Reached $20M in Crypto Assets under Management

Launched the CoinDepo Ambassador Program

-

Q3:

Added Avalanche (AVAX) and Polygon (MATIC) Support

Reached 10K Active Users

-

Q4:

Added Spanish Language to CoinDepo Platform

Added Cosmos (ATOM) Support

2024

-

Q1:

Opened Head Office in Singapore

Added Tron (TRX) Support

Reached 15K Active Users

Reached $40M in Crypto Assets under Management

-

Q2:

Opened Regional Office in London

Added USDT TRC20 and USDT BEP20 Support

Opened Regional Office in Dubai

Launched Token Interest Rewards Accounts

-

Q3:

Released Instant Swap Feature

Launched CoinDepo Token Private Sale

Started Cooperation with Damark Charity Foundation

Integrated with Fiat Payment Providers in the LATAM Region

Reached $60M in Crypto Assets under Management

-

Q4:

Release of DeFi Token Sale Functionality

Launch of COINDEPO Token Referral Program

Adding SOL, DOGE, TON, ADA, LINK, SHIB Support

Expanding of Language Support on the Platform

Reached 30K Active Users

Reached $90M in Crypto Assets under Management

2025

-

Q1:

Launch of CoinDepo Token Pre-Sale

Reached $100M in Crypto Assets under Management

Release of Instant Credit Line without Collateral Account

-

Q2:

Adding XLM, PEPE, AAVE, ETC Support

Reached 60K Active Users

Adding NEAR, ONDO, FIL, ALGO Support

Reached $140M in Crypto Assets under Management

Adding Tether Gold (XAUt) and PAX Gold (PAXG) Support

- Q3:

-

Q4:

Listing of COINDEPO Token on MEXC

Release of COINDEPO Token Advantage Program

Listing of COINDEPO Token on Bitmart

Establishment of CoinDepo El Salvador Entity with BSP License

Listing of COINDEPO Token on Pionex Global and Pionex US

Quarterly Finacial Report Publication

Reaching 100K Active Users

2026

-

Q1:

Establishing of EU CoinDepo Entity with VASP License

COINDEPO Token Governance System Development

CoinDepo Bug Bounty Program Launch - Powered by CertiK

Adding New Assets Support

-

Q2:

CoinDepo Governance System Release

Launch of the CoinDepo Instant Swap Functionality

Updating Verification Process in Accordance with MiCA Regulations

Adding New Assets Support

-

Q3:

Integration with European Fiat Payment Providers

Launch of CoinDepo Crypto Credit Card

Release of Crypto Microcredits without Collateral

Adding Precious Metals Support as a New Asset Class

-

Q4:

Integration with a Physical Gold Custodian Provider

Updating the EU Legal Entity to Comply with MiCA Regulations

Integration with Southeast Asian Fiat Payment Providers

CoinDepo Mobile App Release for iOS and Android

FAQ

CoinDepo | Smart Profit

Be smart. Stay with the best to secure your successful financial future.